Beanstalk Farms · November 14th, 2021

100 Days of Beanstalk

A recap of Beanstalk's performance and development to date.

Where Beanstalk Is Now

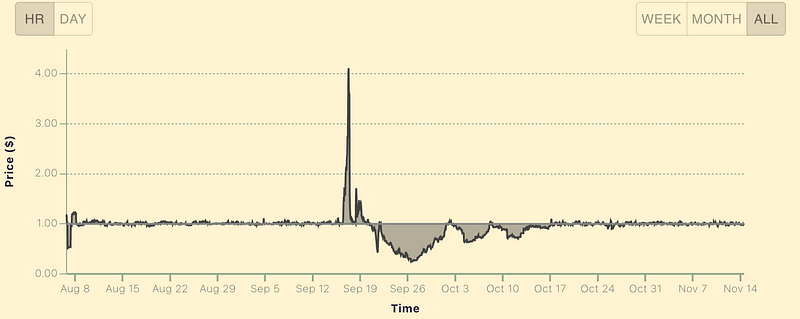

It has been 100 days since Beanstalk was deployed on Ethereum Mainnet. Beanstalk has already been through the ringer: a pump-n-dump ~6 weeks after deployment took Beanstalk from a $2.5M market cap to $40M in a matter of hours.

Beanstalk is designed to respond to any and all market conditions, including pump-n-dumps, and regularly cross the price of 1 Bean above and below $1. While the Bean price went as high as $4 and as low as $0.24 during the height of the pump-n-dump, Beanstalk has started to prove its ability to regularly cross the price of 1 Bean back and forth across $1 in response to market conditions: the price of 1 Bean has crossed $1 over 500 times since the pump-n-dump.

The magnitude of the capital that rushed in, and immediately out of Beanstalk (~$25M of ETH vs. $2.5M market cap) created a major test for Beanstalk. The verdict: Beanstalk is just getting started.

An Organic Community

The first Beanstalk roadmap was released in early October and oriented around the following goals:

- Organize the community to work together to put Beanstalk in a position to succeed over the long term. An inspired, organized and driven community is essential to the long term success of Beanstalk.

- Encourage discourse within the community on what is the best plan of action to make Beans the primary stablecoin protocol of DeFi. A lively community discourse centered around the right topics will drive high quality attention to Beanstalk.

- Outline our ideas for how the community’s time and resources should be allocated as of 10/6/21.

The community that has grown around Beanstalk over the past month, their genuine interest in making Beans the ubiquitous stablecoin of DeFi, and insights into how to give Beanstalk the best opportunity to make that happen is cause for excitement. The quality of discourse in the Beanstalk Discord server has been inspiring.

The Beanstalk roadmap has been updated to incorporate feedback received from the community over the past month. Before diving into the updated roadmap, here is a status update on the October items from last month’s roadmap.

October Review

AMA: Beanstalk Farms hosted 2 AMAs in October. If you want to catch up you can find both of the recordings below:

Econ Analysis: The economic analysis of the first major debt cycle has yet to be written. There has been an abundance of other things to work on and not enough time to write an economic analysis that would add much value or clarity beyond what has already been communicated in the Discord server (chat, AMAs, Beanstalk A&T U). Furthermore, the relevant economic data continues to change regularly. While the current state of Beanstalk has stabilized somewhat, there is not sufficient information to issue a formal report yet. In the future, a thorough economic analysis may be more appropriate.

Subgraph: The subgraph for the Beanstalk contract to the decentralized graph network has been deployed and the integration of the decentralized subgraph into bean.money has begun. You can check out the subgraph here.

Improve Tooltips: New descriptions for every existing tooltip and an additional set of tooltips to further improve clarity for each transaction have been added to bean.money.

Telegram Bots: While the Telegram bots have not been finished, there has been major progress in getting these developed: in early November, a high quality developer joined Beanstalk Farms to take the lead on a full suite of Telegram bots. Funds were allocated to hire them through a dev budget Snapshot proposal and development is now underway. The first Telegram bot is being tested and is almost ready for deployment.

Reddit: Beanstalk Farms made its first post on r/CryptoCurrency that you can check out here.

Select Auditor: Finding an auditor of sufficient quality for the Beanstalk audit has been challenging. Recently, there has been more success. We are optimistic Beanstalk will contract at least one high quality auditor by the end of the year.

Dev Budget: The dev budget has already started to create a lot of value for Beanstalk. As part of the dev budget BIP, the Silo (the Beanstalk DAO) hired its first dev. Since then, multiple Snapshot proposals have hired additional devs. There are now more than a handful of quality developers that also want to start working on Beanstalk.

Marketing Budget: The marketing budget has also created immediate value for Beanstalk. As part of the marketing budget BIP, the Silo hired its first community organizer. They have led the way in creating a close-knit, curious community that has us incredibly enthusiastic about the future of Beanstalk. There have already been three proposals passed to allocate the marketing budget, including hiring a social media manager.

More

In addition to completing many of the items on the October Roadmap, there were a number of other notable events over the past month.

APY Calcs: Due to popular request, APYs were added to bean.money for the Silo and Field and the formulas behind each calculation were published here.

Beanstalk A&T U: Beanstalk Farms hosted the first two Beanstalk A&T University (Agricultural and Technical) classes. Dozens of Farmers came to class to ask questions and learn about the mechanics of Beanstalk. Going forward, there will beBeanstalk A&T U classes on a regular (hopefully weekly) basis. If you want to catch up, you can listen to the recordings below:

BIP-2: A few days ago, BIP-2, which 1) improved the tax efficiency of transactions that immediately reinvest harvests and claims into Beanstalk, and 2) adjusted 4 of the Weather Change cases passed and was committed. Since BIP-2 was committed, the rate of reinvestment into Beanstalk has increased significantly.

Bounty Program: The first marketing Snapshot proposal created a community bounty program that is hosted by layer3.xyz and running for a couple more days. Check it out here.

Themes: For a few days, bean.money had a spooky theme to celebrate Halloween:

Now, autumn has come to Beanstalk Farms:

Peg: Most importantly, the price of 1 Bean has started to more regularly oscillate around $1. The performance of Beanstalk through the pump-n-dump is now a strong tailwind for its development.

Where Beanstalk is Going

While its first 100 days have been incredible, the future of Beanstalk is even more exciting. Now that Beanstalk has demonstrated its ability to stabilize the Bean price around $1, Beanstalk Farms has started charting out and working on the next steps to develop Beanstalk from its current infant state to a full-fledged DeFi behemoth.

Infancy

Publius often describes Beanstalk as being in an infant state. While Beanstalk has the potential to become the largest stablecoin issuer and be completely decentralized, self-governing, and censorship resistant, it still requires some nursing and neck support in order to fulfill its potential.

Some key axes to evaluate the current stage of development of Beanstalk are:

Chain: Ethereum Mainnet only.

Community: Early stages of forming and organizing.

Development: Only 1 decentralized team (Beanstalk Farms) working on Beanstalk.

Economics: Beans and Pods are the only liquid assets in the ecosystem.

Liquidity: Beans only trade in the BEAN:ETH Uniswap V2 pool, where there is shallow liquidity for Beans. There is almost no liquidity for Pods, and Pod sales must be performed OTC.

Utility: Beans can only be used within Beanstalk.

Despite its infant state, Beanstalk has put in a promising performance to date.

Adulthood

In its adult form, Beanstalk will look a lot different than it does today:

Chain: Ethereum Mainnet, decentralized Ethereum L2s, and other blockchains with decentralized EVM-compatible bridges.

Community: A diverse, decentralized, well-organized global community.

Development: Multiple decentralized teams working on Beanstalk.

Economics: All Beanstalk assets are as fungible as possible. Beans, Stalk, Seeds, and SiloBeans are ERC-20 tokens. Deposits and Withdrawals are ERC-1155 tokens, fungible within a Season of Deposit.

Utility: Beans are the primary USD stablecoin of DeFi and have near 0% carrying costs. Stalk and Seeds are incorporated as interest bearing collateral in various protocols.

Liquidity: There is deep liquidity for Beans across a variety of DEXs, liquidity pools, and pairs with other assets including Stalk, Seeds, and SiloBeans. There are liquid, decentralized, somewhat efficient markets for Pods, Deposits and Withdrawals.

Getting from infancy to adulthood is easier said than done, but with a focused, driven, and decentralized effort Beanstalk will get there.

How Beanstalk Will Get There: An Updated Roadmap

Looking ahead through the rest of the year and beyond, there is much to be done. As always, the Beanstalk Farms roadmap is constantly evolving in light of new information and may change based on community feedback.

Rest of 2021

Community: As Beanstalk continues to prove its economic model, it is most important that a driven, dynamic, decentralized community continues to form around Beanstalk.

Accordingly, in addition to doing AMAs on a regular basis, Beanstalk Farms will 1) start holding weekly Beanstalk A&T University classes to educate farmers on how Beanstalk works and answer any lingering questions, and 2) host a weekly Beanstalk Farms call to facilitate self-organization by the community. A community with a firm understanding of the current and intended future state of Beanstalk remains a top priority.

Expect to see more activity around BeaNFTs, a winter theme for the website, and more bounty programs in the coming weeks.

Development: Beanstalk has started attracting high quality developers. Multiple decentralized teams of high quality developers is essential to the long term success of Beanstalk. Over the past week, two Snapshot proposals passed to add two new anonymous developers to Beanstalk Farms. Beanstalk Farms will continue to add high quality developers and also source talent for a second decentralized development team. Some development items on the list for the rest of 2021 are:

- The subgraph for the BEAN token will be deployed to the decentralized graph network. Both decentralized subgraphs will be further incorporated into the website and assist development of the Telegram bots.

- The Telegram bots will start providing useful, up to date information about Beanstalk, the BEAN:ETH pool, and more.

- Beanstalk Farms will continue working to ready the bean.money code to be open-sourced and continue to build out its functionality. We will paginate the website to create room for new features such as an advanced analytics page, a governance page, a BeaNFT page, etc.

- There has been a lot of interest in a decentralized exchange for Pods. A few members of the community have started developing a simple v1 Pod Marketplace that allows basic exchanges of Pods in a decentralized fashion. Additionally, development will start on a more complex v2 Pod Marketplace that facilitates more Pod liquidity.

- Documentation for Beanstalk will start being built out. Beanstalk Farms will create a GitBook for all Beanstalk-related information.

- As Beanstalk continues to create stability in the Bean price around $1, it is appropriate to start adding utility for Beans by actively attracting other protocols to incorporate Beans. Pursuing organic integrations will increase utility for Beans and put Beanstalk in a position to grow in a decentralized fashion. The community has already presented various opportunities for integrations. One potential integration that would increase stability, utility and demand for Beans is to create a BEAN:3CRV Curve pool. Beanstalk Farms hopes to have facilitated at least one Bean integration before the end of the year.

- Whereas the first roadmap did not include any plans for modifications to the Beanstalk economic model, as more data has come in it makes sense to start making minor tweaks to Beanstalk to improve its overall efficiency and chance for success. For example, Beanstalk Farms will propose a BIP to gradually lower the duration Withdrawals are Frozen for. The specifics of this BIP, including the rate of decreases of duration and the new freeze duration, are an open conversation. Other minor tweaks Beanstalk Farms is thinking about proposing in the coming weeks include changing the Minimum and Maximum Soil Rates to incorporate the Weather, and adding time weighted average liquidity to the oracle.

- In addition to an Audit BIP, Beanstalk Farms will also propose a BIP to continue to fund its development and marketing efforts of Beanstalk into 2022.

Content: Having more active content creation around and about Beanstalk is important. A marketing budget Snapshot proposal to hire Anish K. Mitra as the first social media manager for Beanstalk Farms passed this week. Follow @beanstalkprotocol on Instagram and TikTok for new content.

Beanstalk Farms will continue to create more information to improve the understanding of Beanstalk and the bean.money website, including a guide on transaction settings and leveraging tax efficiency improvements from BIP-2.

Publius will appear on at least one podcast this month.

Audit: Selecting a high quality auditor (or auditors) and beginning the Beanstalk audit in the near future will be a major milestone for Beanstalk. Once Publius has selected an auditor they feel is of sufficient quality, the audit budget must be approved and funded by a BIP that will mint new Beans to pay for the audit.

Selecting an auditor that will retain a continuous relationship with Beanstalk to audit future BIPs in a timely manner is an important consideration. Beanstalk may benefit from having multiple auditors. Expect a proposal to fund at least one audit by the end of the year.

2022

Looking ahead to 2022, there is one major change in Beanstalk Farms’ plans for Beanstalk worthy of note. The October Roadmap highlighted that there were no plans to work on an L2 integration for Beanstalk. After receiving a lot of feedback that an L2 integration is important to Bean Farmers, Beanstalk Farms has changed course and started designing a complementary L2 Beanstalk.

In addition to an L2 integration, some other large targets for Beanstalk development for 2022 are to:

- Finish the initial security audit(s).

- Make Stalk and Seeds tradable ERC-20 tokens.

- Make Bean and LP Deposits tradable ERC-1155 tokens.

- Approve and fund at least 1 official Beanstalk development team through a BIP, independent of Publius.

The community rapidly growing around Beanstalk is an exciting indicator for what is to come! Beanstalk Farms is thrilled to be a part of the process.